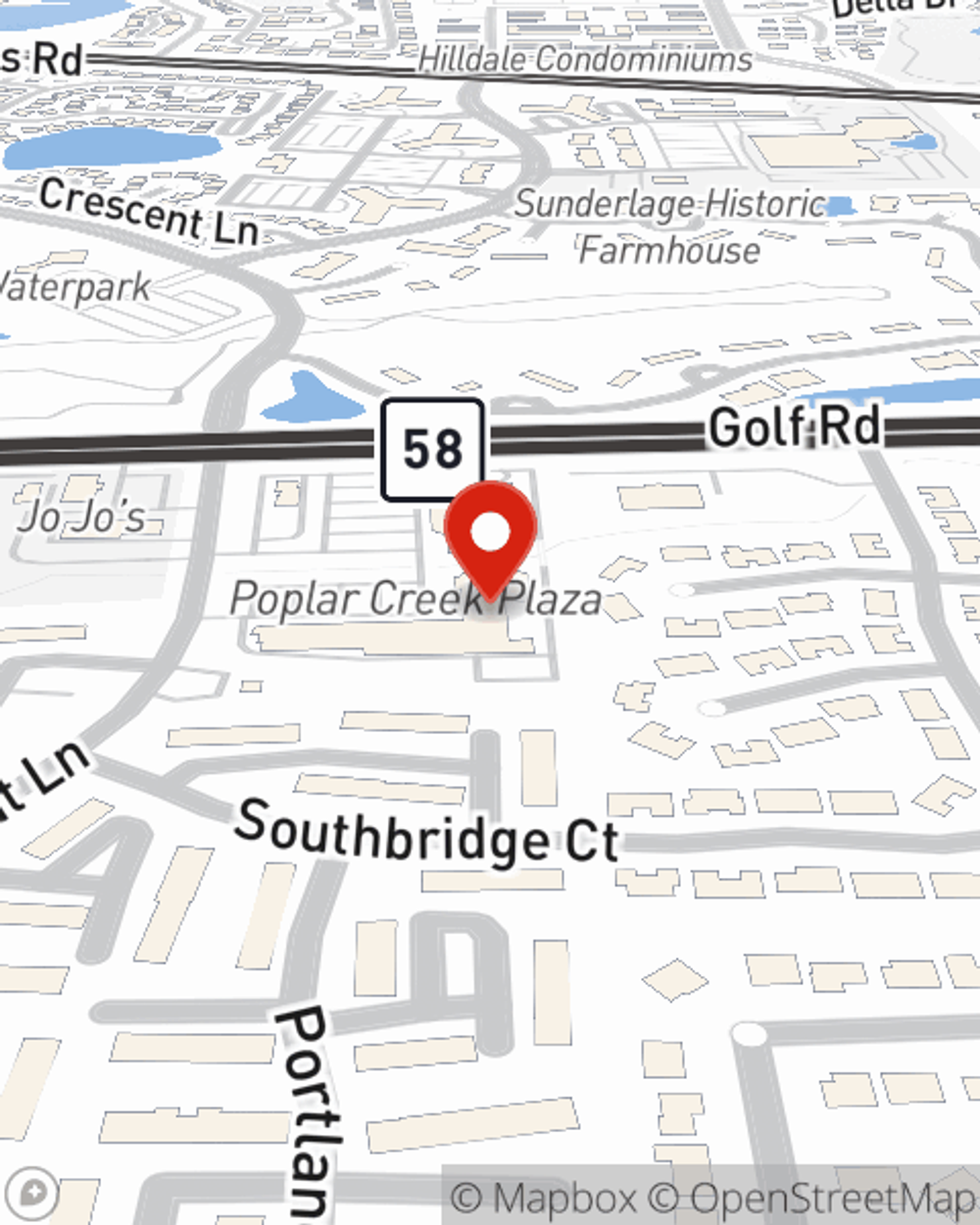

Insurance in and around Schaumburg

Great insurance with your good neighbor

Cover what's most important

Would you like to create a personalized quote?

- Barrington

- Hoffman Estates

- Palatine

- Roselle

- Elgin

- Streamwood

- Hanover Park

- Arlington Heights

- Chicago Metro

- State of Illinois

Let Us Help You Create A Personal Price Plan®

Everyone loves saving money. Create a coverage plan that helps protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, you can create a plan that’s right for you. Contact Kyle Engelbrecht for a Personalized Price Plan.

Great insurance with your good neighbor

Cover what's most important

Insurance For Every Step Of The Way

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with competitive prices, great claims service and outstanding coverage options.

Simple Insights®

This RV travel checklist helps you pack for your trip

This RV travel checklist helps you pack for your trip

If a road trip is on your agenda, this RV travel checklist can help you prepare for the open road by focusing on RV maintenance and other RV essentials.

Why cleaning your chimney is important

Why cleaning your chimney is important

Fireplaces provide warmth and ambiance in the winter, but build-up can occur in the flue and be hazardous. Learn how to keep a clean chimney.

Kyle Engelbrecht

State Farm® Insurance AgentSimple Insights®

This RV travel checklist helps you pack for your trip

This RV travel checklist helps you pack for your trip

If a road trip is on your agenda, this RV travel checklist can help you prepare for the open road by focusing on RV maintenance and other RV essentials.

Why cleaning your chimney is important

Why cleaning your chimney is important

Fireplaces provide warmth and ambiance in the winter, but build-up can occur in the flue and be hazardous. Learn how to keep a clean chimney.